What is Credit Card Insurance?

Credit card insurance is a safety net. It helps cardholders in emergencies. This insurance covers losses. These losses can be theft, travel issues, or purchases gone wrong.

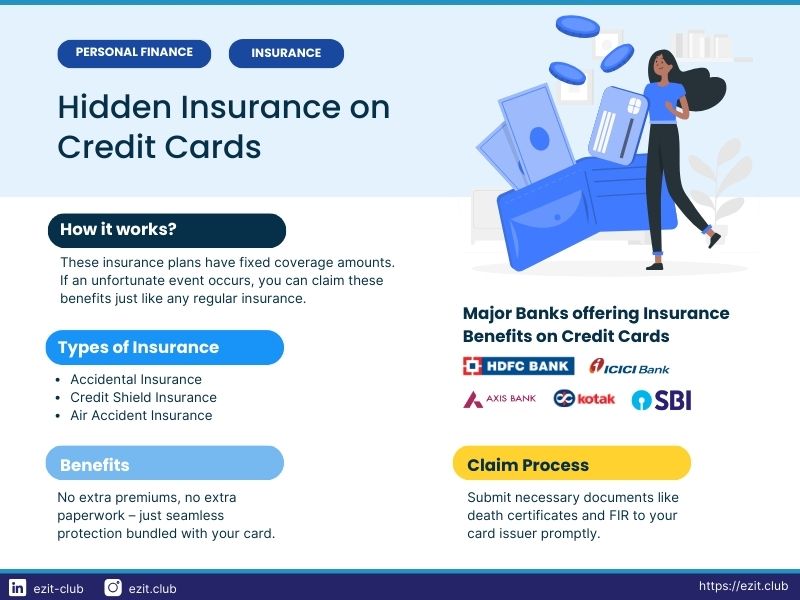

Types of Credit Card Insurance

There are different types. Let’s explore them.

- Purchase Protection: Protects items bought with the card.

- Travel Insurance: Covers travel mishaps like lost bags.

- Rental Car Insurance: Helps if rental cars get damaged.

- Extended Warranty: Extends warranty on items bought.

How Does Credit Card Insurance Work?

It is simple. Use your credit card to buy something. If something goes wrong, you can claim. You must provide proof. Proof can be receipts or police reports.

Benefits of Credit Card Insurance

There are many benefits. Here are a few.

- Peace of Mind: Feel safe when shopping.

- Cost Savings: Save money on unexpected events.

- Convenience: Easy to make claims.

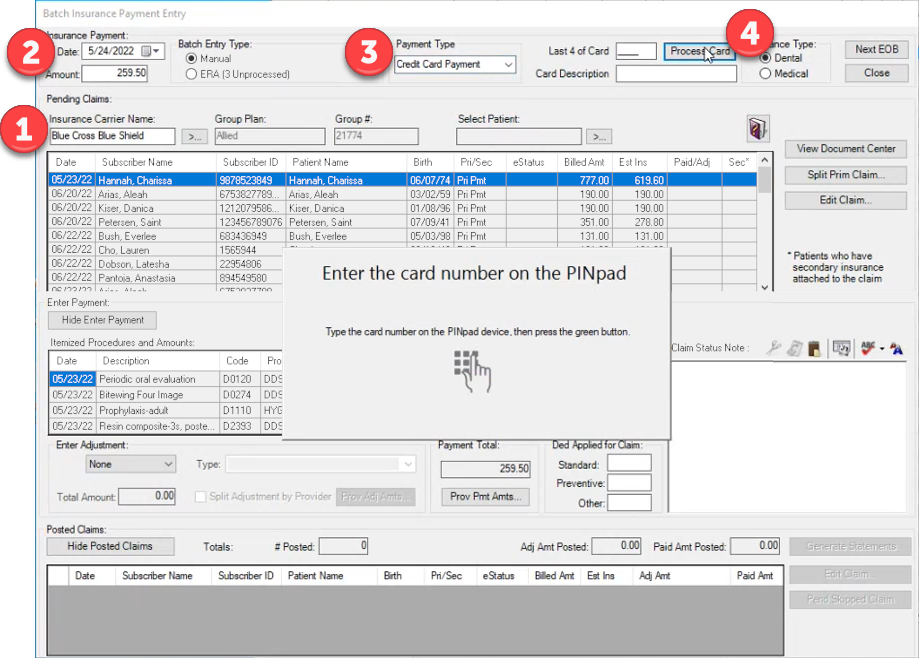

Steps to Make a Credit Card Insurance Claim

Follow these steps to make a claim.

- Read the Policy: Know what is covered.

- Keep Documents: Save receipts and important papers.

- Contact the Company: Call or email your card company.

- Submit a Claim: Fill forms and send documents.

- Follow Up: Check the status of your claim.

Things to Remember

Here are some important things.

- Not all cards have insurance.

- Coverage limits may apply.

- Claims must be made in time.

Common Challenges in Credit Card Insurance Claims

Sometimes, making a claim can be hard. Here are common issues.

- Missing Documents: Keep all papers safe.

- Time Limits: Make claims quickly.

- Understanding Coverage: Know what is covered.

How to Avoid Claim Rejection

Nobody likes rejection. Follow these tips to avoid it.

- Read the terms carefully.

- Provide all required documents.

- Submit claims within time.

Frequently Asked Questions

What Is Credit Card Insurance?

Credit card insurance covers losses from theft or damage when using your card.

How Do I File A Credit Card Insurance Claim?

Contact your credit card provider. Provide necessary documents and details for your claim.

What Does Credit Card Insurance Cover?

It typically covers theft, damage, or loss of items purchased with your card.

Are There Exclusions In Credit Card Insurance?

Yes, exclusions vary. Common ones include pre-existing conditions and unauthorized purchases.

Conclusion

Credit card insurance is helpful. It protects you from losses. Always read the policy. Keep documents safe. Act fast when making claims. This guide helps you understand credit card insurance claims. Stay informed and protected.

Read More:

- How to File a Hospital Claim: Step-by-Step Guide

- Slip And Fall Settlement Tips: Maximize Your Claim

- Best Auto Claim Attorney USA: Unrivaled Legal Expertise

- Roof Insurance Claim Denied: Uncover Solutions Today

- Denied Surgery Insurance Claim: Navigating Your Next Steps

- Irs Tax Refund Claim Process: Simplified Guide

- Health Insurance Reimbursement Claim: Maximize Your Benefits

- Injury Accident Settlement Guide: Maximize Your Compensation